Bitcoin Market Report: FOMC Impact, Institutional Adoption, and Price Forecasts

Date: January 29, 2025

1. Overview

The cryptocurrency market remains at a pivotal moment, with Bitcoin ($BTC) maintaining its position above $100,000 as macroeconomic events, institutional adoption, and central bank policies drive market sentiment. This report provides an in-depth analysis of key developments, including the Federal Open Market Committee (FOMC) meeting, the Czech National Bank's Bitcoin reserve proposal, institutional accumulation trends, and Bitcoin’s projected price trajectory based on different economic scenarios.

2. Macroeconomic Factors Affecting Bitcoin

2.1 FOMC Decision and Its Impact on Bitcoin

- The Federal Reserve is set to hold interest rates steady at 4.25%-4.50%, pausing its rate-cutting cycle after three consecutive reductions.

- Hawkish language in the post-meeting statement could delay further cuts, pressuring Bitcoin in the short term.

- Market pricing suggests two rate cuts in 2025, likely starting in June, but a surprise 25bps rate cut earlier could act as a bullish catalyst.

- Trump’s calls for rate cuts may influence monetary policy in the long run, with Fed Chair Jerome Powell expected to maintain independence in the short term.

- PCE inflation data release (Jan. 31) will be closely watched—lower inflation could push Bitcoin higher.

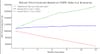

2.2 Bitcoin’s Reaction to the FOMC Decision

- Base Case (No Cut in January): Bitcoin remains range-bound ($100K-$105K) with potential downside toward $98K-$91K.

- Dovish Case (Rate Cut or Hints of Early Cuts): Bitcoin could break $110K, targeting $125K-$150K.

- Hawkish Case (Delay in Rate Cuts): Bitcoin could face temporary pressure, testing support near $95K.

3. Institutional and Central Bank Adoption Trends

3.1 Czech National Bank’s $7.3 Billion Bitcoin Proposal

- Governor Aleš Michl proposes allocating 5% ($7.3 billion) of Czechia’s $146 billion reserves to Bitcoin.

- If approved, Czechia would become one of the first nations to hold Bitcoin in official reserves.

- This move aligns with global institutional trends, as:

- Metaplanet (Japan) plans a $745M Bitcoin acquisition.

- Arizona’s Senate approved a Bitcoin reserve bill, signaling state-level adoption in the U.S.

- MicroStrategy recently purchased $1.1B in Bitcoin, reinforcing the asset’s long-term store-of-value potential.

3.2 Institutional Whale Accumulation Trends

- CryptoQuant reports that Bitcoin whale wallets saw inflows exceeding 22,770 BTC recently, indicating strong institutional demand.

- More than 50% of BTC spot trading is dominated by U.S. institutions, with increasing purchases through Coinbase Prime Brokerage.

- The rise in new whales (holding 1,000+ BTC for under 155 days) reflects bullish sentiment and ongoing market optimism.

4. Bitcoin Market Trends and Growth Outlook

4.1 Price Action & Market Sentiment

- Bitcoin currently trades around $101,800-$102,900, defending the $100K psychological level amid macro volatility.

- The asset rebounded from a dip to $97,777 on Monday, indicating strong institutional accumulation at lower levels.

4.2 Key Growth Drivers for 2025

- Expanding Bitcoin ETF holdings (now at 1.1M BTC).

- MiCA regulation reshaping the European crypto landscape.

- DeFi sector expansion targeting $200B TVL.

- RWA tokenization growth, including Hamilton’s Bitcoin-based treasury platform ($1.7M funded).

4.3 Market Challenges

- Fraudulent “DeepSeek” tokens on Solana briefly reached $48M market cap, contributing to market volatility.

- AI-driven stock market turbulence briefly dragged BTC below $100K.

- 106% increase in political-themed token scams following Trump’s official meme coin launch.

5. Bitcoin Technical Analysis and Trading Recommendations

5.1 Price Trend

- BTCUSDT has shown a strong bullish trend since October 2024, currently trading around $101,880.

- The trend is characterized by higher highs and higher lows, suggesting a continued upward trajectory.

5.2 Key Levels

- Resistance:

- $110,000 - A major resistance level; a break above could trigger accelerated bullish momentum.

- Support:

- $95,000 - Strong primary support where buyers are expected to step in.

- $90,000 - Secondary support in case of broader market correction.

5.3 Momentum Indicators

- Relative Strength Index (RSI): 53.07, indicating neutral momentum (neither overbought nor oversold).

- Volume Analysis:

- Recent volume at 7,934K, showing continued market participation.

- Volume spikes suggest institutional accumulation at lower price levels.

5.4 Trading Recommendations

- Conservative Entry: Pullback to $98,000.

- Aggressive Entry: Break above $110,000.

- Stop Loss Levels:

- $94,000 (conservative approach).

- $97,000 (aggressive approach).

- Risk Management:

- Use 2-3% of portfolio per trade.

- Aim for a minimum 1:3 risk/reward ratio.

5.5 Market Outlook

- While the market structure supports further upside, consolidation patterns suggest cooling momentum.

- External factors, such as macroeconomic events and regulatory developments, may cause rapid price shifts.

6. Today’s Sentiment Analysis

- Market Sentiment: Mixed, with cautious optimism amid macroeconomic uncertainty.

- Institutional Participation: Increasing, as major funds continue accumulating BTC at key support levels.

- Retail Traders: Divided, as fear of regulatory uncertainty weighs on confidence despite bullish ETF inflows.

- Key Concerns: FOMC decision impact, regulatory developments, and short-term liquidity.

- Potential Triggers: A dovish Fed statement or stronger-than-expected institutional inflows could drive Bitcoin past $110K

💡

Bitcoin remains in a consolidation phase ahead of major macroeconomic decisions. The FOMC’s stance on rate cuts, coupled with institutional accumulation and central bank reserves, will dictate Bitcoin’s next major price movement. While short-term volatility is expected, the long-term fundamentals remain strongly bullish.

Key Takeaways:

- FOMC holding rates steady could create short-term pressure but maintain long-term optimism.

- Institutional accumulation continues, reinforcing Bitcoin’s position as a macro asset.

- BTC targets:

- Bearish case: $91K support.

- Neutral case: $115K-$125K mid-year.

- Bullish case: $150K+ in a strong rate-cut cycle.